Tax and Fee Measures

Fiscal Summary of Measures

|

|

|

2022/23 |

Full Year |

|

millions of dollars |

millions of dollars |

||

|

Education Property Tax Measure |

|

|

|

|

Education Property Tax Rebate – increased |

-103.4 |

-206.7 |

|

|

Existing education property tax credits and rebates – reduced |

32.7 |

65.2 |

|

|

Personal Measure |

|

|

|

|

New Renters Tax Credit – introduced |

- |

- |

|

|

Business Measures |

|

|

|

|

Health and Post-Secondary Education Tax Levy – enhanced |

-2.2 |

-8.9 |

|

|

Fuel Tax – adjusted |

-0.2 |

-0.2 |

|

|

-2.4 |

-9.1 |

||

|

Fee Measure |

|

|

|

|

Vehicle Registration Fees – reduced |

-11.0 |

-15.0 |

|

|

Tax Credit Extensions |

|

|

|

|

Community Enterprise Development Tax Credit – made permanent |

- |

- |

|

|

Small Business Venture Capital Tax Credit – made permanent |

- |

- |

|

|

|

- |

- |

|

|

- |

|||

|

Total Fiscal Impact |

-84.1 |

-165.6 |

|

Note: A negative amount is a cost to government and a benefit to taxpayers.

Education Property Tax Measure

Education Property Tax Rebate

2022/23 fiscal impact: -$103.4 million

Manitoba will continue the phase-out of education property taxes, as was committed to under the $2,020 Tax Rollback Guarantee, by increasing the Education Property Tax Rebate.

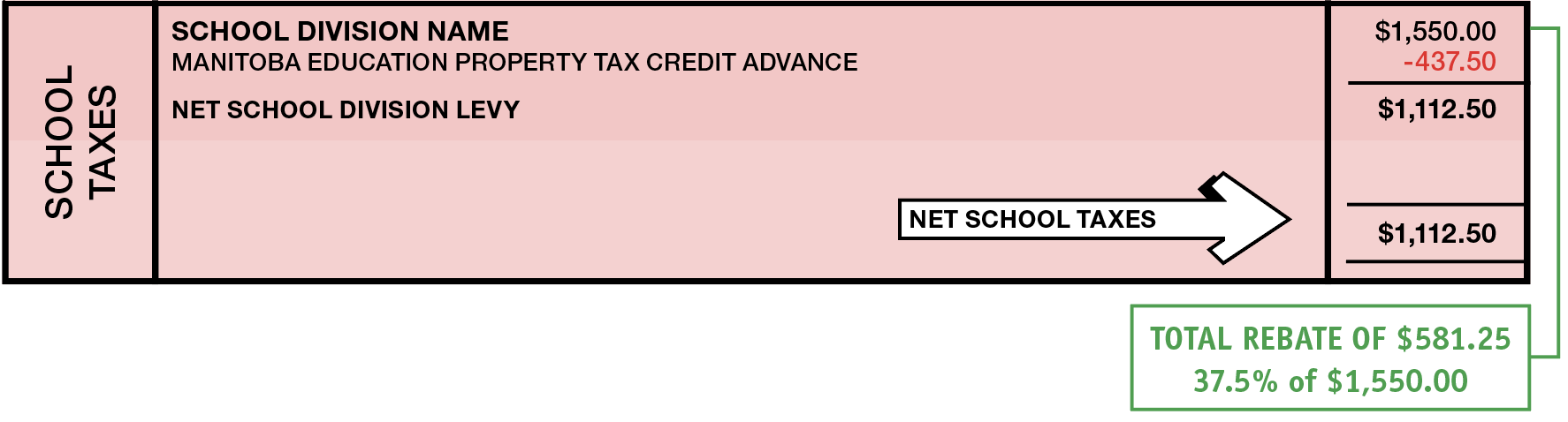

The Rebate for residential and farm properties will increase from 25 per cent in 2021 to 37.5 per cent in 2022 and

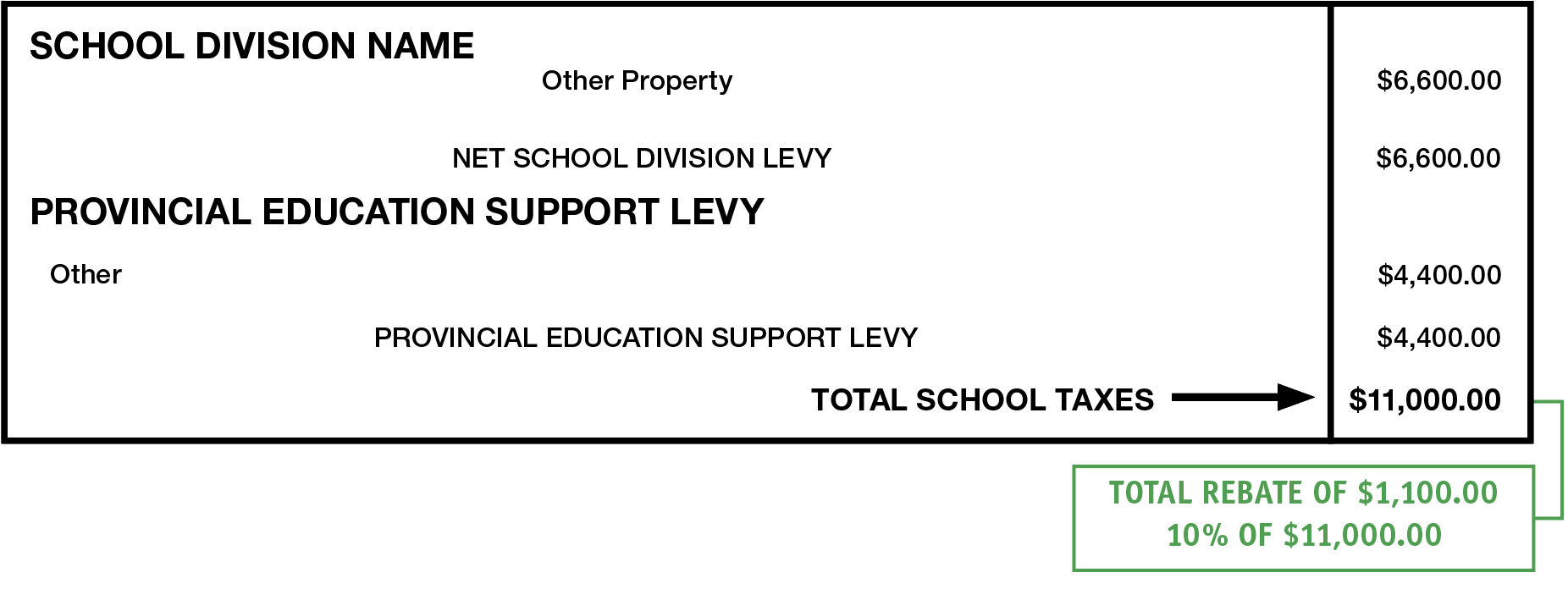

50 per cent in 2023, while other properties will continue to get Rebates of 10 per cent. This represents total Rebates equal to $246.5

million in 2021, $349.9

million in 2022 and $453.2

million in 2023.

Total Rebates for each property category in 2021, 2022 and 2023 are shown in the table below:

|

Property Type |

Total Rebates ($M) |

||

|

2021 |

2022 |

2023 |

|

|

Residential |

179.3 |

269.0 |

358.6 |

|

Farm |

27.4 |

41.1 |

54.8 |

|

Other |

39.8 |

39.8 |

39.8 |

|

TOTAL |

246.5 |

349.9 |

453.2 |

As a result of the increases, Rebates for homeowners will increase from an average of $387 in 2021 to $581 in 2022 and to $774 in 2023.

Rebates are calculated based on the gross education property taxes on property tax statements, including both the school division special levy and the education support levy.

- Owners of residential and farm properties will receive a 37.5 per cent rebate of the school division special levy payable in 2022 and 50 per cent in 2023.

Illustrative school tax portion of a 2022 residential property tax statement:

- Owners of other properties, such as businesses, industrial, railway and institutions, will receive a 10 per cent rebate in 2022 and in 2023.

Illustrative school tax portion of a 2022 business property tax statement:

Property owners will continue to pay education property taxes but will receive the Education Property Tax Rebate cheque in the same month that municipal property taxes are due. No application will be necessary by property owners as the Education Property Tax Rebate will be automatically sent by the province. Farm property owners will still be required to apply for the Farmland School Tax Rebate.

The phase-out continues to include a freeze on total education property tax revenue at the 2020 amount.

Education Property Tax Credits and Rebates

2022/23 fiscal impact: $32.7 million

While all properties owners who are subject to education property taxes will receive the Education Property Tax Rebate, some owners are also eligible for other education property-tax related credits and rebates. The Education Property Tax Credit/Advance, the Seniors Education Property Tax Credit, the Seniors School Tax Rebate are available to Manitoba residents on their principal residences. The Farmland School Tax Rebate is available to Manitoba residents on farmland but not farm buildings.

In order to ensure the phase out of education property taxes will proceed at the same pace for all property owners, existing education property tax credits and rebates are automatically adjusted in line with increases to the Education Property Tax Rebate, as was done in 2021.

|

|

2021 |

2022 |

2023 |

|

Education Property Tax Credit and Advance |

Up to $525 |

Up to $438 |

Up to $350 |

|

Seniors School

|

Up to $353

|

Up to $294

|

Up to $235

|

|

Seniors Education

|

Up to $300

|

Up to $250

|

Up to $200

|

|

Farmland School

|

Up to 60% of school tax to a maximum of $3,750 |

Up to 50% of school tax to a maximum of $3,125 |

Up to 40% of school tax to a maximum of $2,500 |

The following table provides illustrative examples of the impact of Rebate changes from 2021 to 2023.

It shows that a Manitoban who qualifies for both the Education Property Tax Credit/Advance and Education Property Tax Rebate on their principal residence will experience the same proportional benefits as another residential property owner who does not qualify for the Education Property Tax Credit/Advance.

The table also shows that a Manitoban who qualifies for both the Farmland School Tax Rebate and Education Property Tax Rebate on farmland will experience the same proportional benefits on their farm buildings as another property owner who may not be a resident of Manitoba.

|

|

Principal Residence |

Other

|

|

Farm

|

Farm

|

|

|

Gross School Tax |

$ 1,550 |

$ 1,550 |

Gross School Tax |

$ 5,600 |

$ 5,600 |

|

|

Property Tax Credit |

$ 700 |

$ 0 |

Farmland Rebate |

$ 4,480 |

||

|

Net School Tax |

$ 850 |

$ 1,550 |

Net School Tax |

$ 1,120 |

$ 5,600 |

|

|

Total Credits and Rebates |

$ 700 |

$ 0 |

Total Credits and Rebates |

$ 4,480 |

$ 0 |

|

|

2021 |

2021 |

|||||

|

Gross School Tax |

$ 1,550 |

$ 1,550 |

Gross School Tax |

$ 5,600 |

$ 5,600 |

|

|

Rebate |

$ 388 |

$ 388 |

School Tax Rebate |

$ 1,400 |

$ 1,400 |

|

|

Property Tax Credit |

$ 525 |

$ 0 |

Farmland Rebate |

$ 3,360 |

||

|

Net School Tax |

$ 637 |

$ 1,162 |

Net School Tax |

$ 840 |

$ 4,200 |

|

|

Change from 2020 |

-25% |

-25% |

Change from 2020 |

-25% |

-25% |

|

|

Total Credits and Rebates |

$ 913 |

$ 388 |

Total Credits and Rebates |

$ 4,760 |

$ 1,400 |

|

|

2022 |

2022 |

|||||

|

Gross School Tax |

$ 1,550 |

$ 1,550 |

Gross School Tax |

$ 5,600 |

$ 5,600 |

|

|

Rebate |

$ 581 |

$ 581 |

School Tax Rebate |

$ 2,100 |

$ 2,100 |

|

|

Property Tax Credit |

$ 438 |

$ 0 |

Farmland Rebate |

$ 2,800 |

||

|

Net School Tax |

$ 531 |

$ 969 |

Net School Tax |

$ 700 |

$ 3,500 |

|

|

Change from 2020 |

-37.5% |

-37.5% |

Change from 2020 |

-37.5% |

-37.5% |

|

|

Total Credits and Rebates |

$ 1,019 |

$ 581 |

Total Credits and Rebates |

$ 4,900 |

$ 2,100 |

|

|

2023 |

2023 |

|||||

|

Gross School Tax |

$ 1,550 |

$ 1,550 |

Gross School Tax |

$ 5,600 |

$ 5,600 |

|

|

Rebate |

$ 775 |

$ 775 |

School Tax Rebate |

$ 2,800 |

$ 2,800 |

|

|

Property Tax Credit |

$ 350 |

$ 0 |

Farmland Rebate |

$ 2,240 |

||

|

Net School Tax |

$ 425 |

$ 775 |

Net School Tax |

$ 560 |

$ 2,800 |

|

|

Change from 2020 |

-50% |

-50% |

Change from 2020 |

-50% |

-50% |

|

|

Total Credits and Rebates |

$ 1,125 |

$ 775 |

Total Credits and Rebates |

$ 5,040 |

$ 2,800 |

The Rebate, property tax credits and Farmland School Tax Rebate are fully funded by the provincial government through general revenues.

For more information, please contact Location B, page 178.

Personal Measure

New Residential Renters Tax Credit

2022/23 fiscal impact: nil

Effective starting in the 2022 taxation year, Manitoba will replace the renters component of the Education Property Tax Credit with a new renters tax credit that will apply to renters of residential properties. The new credit will fix the annual claim amount at $525, the same amount as in 2021 under the previous tax credit program. The new credit will no longer be calculated based on 20% of annual rents paid, and will instead be calculated as a fixed monthly maximum claim amount, based on the number of months spent renting in a given year. The monthly amount will be $43.75 and will not be income tested. About 45,000 Manitobans who receive non-EIA Rent Assist or who live in social housing will be newly eligible to claim the credit.

The following table shows the maximum credit available for different renters under the Education Property Tax Credit in 2021 versus the new Residential Renters Tax Credit in 2022.

|

Tax Credits for Renters |

|||

|

Non-EIA Rent Assist |

Social Housing |

Other Renters |

|

|

2021 (Education Property Tax Credit) |

Yes

|

||

|

2022 (Renters Tax Credit) |

Yes

|

Yes

|

Yes

|

For more information, please contact Location B, page 178.

Business Measures

Health and Post-Secondary Education Tax Levy

2022/23 fiscal impact: -$2.2 million

Effective January 1, 2023, the exemption threshold is raised from $1.75 million to $2.0 million of annual remuneration. In addition, the threshold below which employers pay a reduced rate is raised from $3.5 million to $4.0 million. Both thresholds will be 60% higher than in 2020.

Increases to the thresholds primarily benefit the following sectors: construction, manufacturing, retailers, wholesalers, professionals and restaurants.

The new higher thresholds will benefit approximately 970 Manitoba employers, including exempting approximately 180 Manitoba employers. These changes further build upon the increases to the levy thresholds announced in Budget 2020 and Budget 2021. In 2020, the exemption threshold was $1.25 million and the threshold below which employers pay a reduced rate was $2.5 million, both of which had been in place since 2008.

For more information, please contact Location D, page 178.

Small Business Venture Capital Tax Credit

2022/23 fiscal impact: nil

Enhancements to the Small Business Venture Capital Tax Credit will be made to benefit Manitobans participating in venture capitals funds, thereby improving access to capital and supporting entrepreneurs.

Fuel Tax Exemption for Peat Harvesting Equipment

2023/23 fiscal impact: -$0.2 million

Effective May 1, 2022, fuel used in off-road operation of peat harvesting equipment is exempt from Manitoba’s Fuel Tax.

Marked fuel can be currently purchased tax exempt when used in off-road machinery and equipment utilized by the farming, mining, commercial logging, commercial fishing and trapping industries. Extending this exemption to peat harvesting equipment supports this industry in Manitoba and is consistent with tax treatment in the majority of Canadian jurisdictions.

For more information, please contact Location D, page 178.

Fee Measure

Reduction in Vehicle Registration Fees

2022/23 fiscal impact: -$11 million

Vehicle registration fees for most non-commercial vehicles will be reduced by a further $10 starting with renewals after June 30, 2022. The vehicle registration fee reduction applies to most types of non-commercial vehicles, such as passenger vehicles, trucks, trailers, and motorcycles/mopeds. This measure completes the government’s commitment to roll back the 30 per cent increase to vehicle registration fees by 2023 a year early, following reductions in Budget 2020 and Budget 2021.

For more information, please contact Location A, page 178.

Extensions to Existing Tax Credits

The Community Enterprise Development Tax Credit , scheduled to expire on December 31, 2022, is made permanent. This tax credit provides a refundable Manitoba tax credit of up to 45% to individuals and corporations who acquire equity capital in community-based enterprises in Manitoba.

The Small Business Venture Capital Tax Credit , scheduled to expire on December 31, 2022, is made permanent. This tax credit provides a non-refundable Manitoba tax credit of up to 45% to individuals and corporations who acquire equity capital in eligible Manitoba enterprises.

For more information, please contact Location C, page 178.

Administrative Tax Measures

Tax on Split Income

Based on an issue identified by the federal government with provincial income tax acts, a minor change will be made to eliminate potential confusion regarding how federal provisions respecting tax on split income are to apply to individuals in Manitoba.

Research and Development Tax Credit

A change will be made to align with extended filing deadlines made by order under the Income Tax Act (Canada) in response to COVID-19.

Statutory Limitations

Changes will establish a statute of limitations on audits and requests for change by taxpayers on taxes collected and administered by Manitoba Finance.

Film and Video Production Tax Credit

Minor changes will be made to confirm that film producers are able to get advance credits prior to a film being completed provided that proper documentation is submitted.

Tax Credit Validation

An extended service agreement will be entered into with the Canada Revenue Agency to undertake increased scrutiny and validation of Manitoba tax credits, following unusually high and potentially improper claims for certain credits. This builds upon work done in 2021 respecting 2020 tax returns where unusually high claims for some tax credits were found to be invalid.

For more information, please contact Location D, page 178.

$2,020 Tax Rollback Guarantee

The $2,020 Tax Rollback Guarantee announced in 2019 promised to save Manitobans an average of $2,020 in tax over four years by removing unnecessary taxes and fees so people can keep more of their hard-earned money. Budget 2021 projected that this commitment would be met one year early, by 2022/23, and Budget 2022 confirms this.

The table below provides a current status update on all measures that have contributed to meeting this commitment and the total annual savings resulting from each:

|

Tax Measure |

Implementation Date |

Total Annual Savings ($M) |

|

Indexing of Basic Personal Amount and Personal Income Tax

|

January 2017 |

161.1 |

|

Retail Sales Tax Rate Reduction from 8% to 7% |

July 2019 |

176.0 |

|

Retail Sales Tax Exemption – Preparing Wills |

January 2020 |

1.0 |

|

Vehicle Registration Fee Reduction |

Starting July 2020

|

45.0 |

|

Retail Sales Tax Exemption – Home Insurance |

July 2020 |

37.5 |

|

Retail Sales Tax Exemption – Preparing Personal Income Tax Returns |

October 2020 |

5.5 |

|

Elimination of Probate Fees |

November 2020 |

7.8 |

|

Retail Sales Tax Exemption – Personal services |

December 2021 |

8.0 |

|

Phasing out of education property taxes net of changes to existing credits (in 2023) |

Starting 2021 |

326.5 |

Contacts For Further Information

A) Manitoba Public Insurance

Contact Centre

Telephone 204-985-7000

Toll-free 1-800-665-2410

B) Manitoba Tax Assistance Office

Manitoba Finance

Telephone 204-948-2115

Toll-free 1-800-782-0771

e-mail: tao@gov.mb.ca

C) Economic Programs Branch

Manitoba Economic Development, Investment and Trade

Telephone 204-945-2700

e-mail: EcDevPrograms@gov.mb.ca

D) Tax Information Branch

Manitoba Finance

Telephone 204-945-5603

Toll-free 1-800-782-0318

e-mail: mbtax@gov.mb.ca

For further information on government programs, individuals can contact Manitoba Government Inquiry by calling 204-945-3744 in Winnipeg or toll-free

1-866-626-4862, or by e-mail at

mgi@gov.mb.ca

.

Interprovincial Comparison of 2022 Tax Rates

|

|

CAN |

BC |

AB |

SK |

MB |

ON |

QC |

NB |

NS |

PE |

NL |

|

Personal Income Tax |

|

|

|

|

|

|

|

|

|

|

|

|

Basic Personal Amount ($) |

14,398 |

11,302 |

19,369 |

16,615 |

10,145 |

11,141 |

16,143 |

11,720 |

8,481 |

11,250 |

9,803 |

|

Top Rate (%) |

33.00 |

20.50 |

15.00 |

14.50 |

17.40 |

20.53 J |

25.75 |

20.30 |

21.00 |

18.37 J |

21.8 |

|

Health Care Premiums ($) |

900 |

||||||||||

|

Health and Education Tax (%) |

1.95 B |

2.15 C |

1.95 D |

4.26 E |

|

2.0 F |

|||||

|

Corporation Income Tax (%) |

|||||||||||

|

Small |

9.0 |

2.0 |

2.0 |

1.0 K |

0.0 |

3.2 |

3.2 |

2.5 |

2.5 |

1.0 |

3.0 |

|

Large |

15.0 |

12.0 |

8.0 |

12.0 |

12.0 |

11.5 |

11.5 |

14.0 |

14.0 |

16.0 |

15.0 |

|

Small business limit ($000) |

500 |

500 |

500 |

600 |

500 |

500 |

500 |

500 |

500 |

500 |

500 |

|

Capital Tax on Banks (%) |

4 |

6 |

5 |

4 |

5 |

6 |

|||||

|

Sales Tax (%) |

5 |

7 |

n/a |

6 |

7 |

8 |

9.975 |

10 |

10 |

10 |

10 |

|

Tobacco Tax (¢ /cigarette) |

14.545 |

32.50 |

27.5 |

29.0 |

30.0 |

18.475 |

14.9 |

25.52 |

29.52 |

27.52 |

32.50 |

|

Fuel Tax |

|||||||||||

|

Gasoline (¢/l) |

10.0 |

14.5 |

0.0 L |

15.0 |

14.0 |

14.7 |

19.2 |

10.87 |

15.50 |

8.47 |

14.5 |

|

Diesel (¢/l) |

4.0 |

15.0 |

0.0 L |

15.0 |

14.0 |

14.3 |

20.2 |

15.45 |

15.40 |

14.15 |

16.5 |

|

Carbon Levy G,H |

|||||||||||

|

Gasoline (¢/l) |

11.05 |

11.05 |

11.05 |

11.05 |

11.05 |

5.66 |

11.05 |

1.10 I |

6.63 |

6.63 |

|

|

Diesel (¢/l) |

13.01 |

13.41 |

13.41 |

13.41 |

13.41 |

7.21 |

13.41 |

1.30 |

8.05 |

8.05 |

As of March 24, 2022

B

Employers with BC remuneration of $500,000 or less don’t pay employer health tax. Between $500,000.01 and $1.5 million pay the reduced

tax amount of 2.925%. Employers with more than $1.5 million pay the tax on their total BC remuneration at 1.95%.

C

Effective January 1, 2023, MB employers with total remuneration in a year of $2.0 million or less are exempted. MB employers with up to

$4.0 million of remuneration pay 4.3% on the amount in excess of $2.0 million. Employers with more than $4.0 million pay the tax on their

total MB remuneration at 2.15%.

D The ON Employer Health Tax rates vary from 0.98% on payroll less than $200,000, up to 1.95% for payroll in excess of $400,000.

E

The QC Health Services Fund contribution rates vary from 1.25% to 4.26% dependent upon sector and total payroll. Employers, other than

a public-sector employer, with total payroll less than $6.5 million are eligible for the reduced contribution rates.

F The NL Health and Post Secondary Education Tax, at a rate of 2%, is payable by employers whose annual remuneration that exceeds $1.3 million.

G On April 1st, 2019, the federal government implemented a carbon pricing system in provincial jurisdictions that do not have a carbon pricing system that aligns with the federal benchmark. The federal government fuel charge applies in MB, AB, SK, ON, and NB.

H Rates apply to April 1, 2022 to March 31, 2023.

I NS operates under a provincial Cap-and-Trade program, the figures listed in the table are estimated costs.

J Includes provincial surtax.

K Saskatchewan&aposs small business corporate income tax rate temporarily dropped from 2% to zero effective October 1, 2020. Beginning July 1, 2022, the small business tax rate will move to 1%. And on July 1, 2023, the small business tax rate will return to 2%.

L The Alberta government announced that starting April 1, Albertans will not pay the provincial fuel tax, and that the government will review the collection of the fuel tax on a quarterly basis and, if required, consider reinstating collection in stages.